Mociones y apelaciones

MOCIONES Y APELACIONES

ÁREA DE PRÁCTICA / ABOGADOS DE MOCIONES Y APELACIONES DE UTAH

Nuestra práctica de litigios de apelación está compuesta por abogados altamente experimentados y dedicados que combinan años de experiencia en litigios en todas las áreas de práctica con un conocimiento único y extenso del litigio de apelaciones especializadas.

ABOGADOS DE MOCIONES Y APELACIONES EN UTAH

Tenemos una amplia gama de experiencia y conocimiento que contribuye al éxito de nuestra firma en los tribunales de apelación estatales y federales.

Utilizamos la experiencia combinada de nuestros abogados con experiencia en juicios y apelaciones para brindar un mejor servicio a nuestros clientes durante cada fase del proceso legal y asegurarnos de que la apelación del cliente no se vea comprometida en la corte. De hecho, nuestros abogados de apelaciones a menudo opinan sobre las implicaciones de una apelación al principio de un caso, y nuestro abogado de apelaciones puede monitorear el juicio para una posible apelación.

Los abogados de apelaciones de Richards Brandt sirven como valiosas fuentes de información para nuestros propios clientes, para los profesionales independientes que manejan apelaciones con poca frecuencia y para otros bufetes de abogados que buscan la visión fresca que brinda el abogado de apelaciones.

Ofrecemos una amplia gama de servicios, desde evaluar los méritos de una apelación o revisar el escrito de apelación de otro abogado, hasta manejar una apelación de principio a fin. Consulte nuestras páginas de artículos, noticias y casos denunciados para ver ejemplos de apelaciones exitosas y pendientes manejadas por Richards Brandt.

Se anima a los abogados y clientes individuales a llamar o enviar un correo electrónico a Richards Brandt en Salt Lake City para concertar una consulta con uno de nuestros abogados. Nuestra práctica de litigios de apelación maneja casos en tribunales de primera instancia y de apelación estatales y federales en todo el país.

PRACTICAS RELACIONADAS

- Grupo de la industria de la construcción

- Defensa criminal e investigaciones regulatorias

- Trabajo y empleo

- Ley familiar

- Derecho sanitario

- Grupo de práctica de derecho de inmigración

- Organizaciones religiosas y sin fines de lucro

- Lesiones personales y pérdida de propiedad

- Transacciones y litigios inmobiliarios

- Transporte y vehículos comerciales

ACTUALIZACIONES DE MOCIONES Y APELACIONES RECIENTES

ABOGADOS DE MOCIONES Y APELACIONES DE RICHARDS BRANDT EN SALT LAKE CITY

PREGUNTAS FRECUENTES (FAQS)

BUSINESS TRANSACTIONS & CORPORATE GOVERNANCE / FEATURED FAQS

P: ¿Es una LLC o una corporación adecuada para mi negocio?

Answered by:

A: To decide which entity is right for you, we look at: liability, taxation, and maintenance. Both corporations and LLC’s have limited personal liability—this means that owners are usually not responsible for business debts. However, corporations and LLC’s are taxed very differently—corporations are classified as a separate taxable entity, whereas LLC’s are typically taxed as a pass-through entity (unless you choose otherwise). And corporations and LLC’s have different levels of maintenance—LLC’s have fewer reporting requirements and can operate solely with members acting as the managers. Conversely, corporations are required to hold certain annual meetings, keep certain records, and appoint boards and officers to manage the company for the stockholders. Every situation is unique so we recommend that you consult with an attorney in making your decision. Contact our firm, Richards Brandt, if we can help you decide which entity is right for you.

P: ¿Es una LLC o una corporación adecuada para mi negocio?

Answered by:

A: To decide which entity is right for you, we look at: liability, taxation, and maintenance. Both corporations and LLC’s have limited personal liability—this means that owners are usually not responsible for business debts. However, corporations and LLC’s are taxed very differently—corporations are classified as a separate taxable entity, whereas LLC’s are typically taxed as a pass-through entity (unless you choose otherwise). And corporations and LLC’s have different levels of maintenance—LLC’s have fewer reporting requirements and can operate solely with members acting as the managers. Conversely, corporations are required to hold certain annual meetings, keep certain records, and appoint boards and officers to manage the company for the stockholders. Every situation is unique so we recommend that you consult with an attorney in making your decision. Contact our firm, Richards Brandt, if we can help you decide which entity is right for you.

P: ¿Es una LLC o una corporación adecuada para mi negocio?

Answered by:

A: To decide which entity is right for you, we look at: liability, taxation, and maintenance. Both corporations and LLC’s have limited personal liability—this means that owners are usually not responsible for business debts. However, corporations and LLC’s are taxed very differently—corporations are classified as a separate taxable entity, whereas LLC’s are typically taxed as a pass-through entity (unless you choose otherwise). And corporations and LLC’s have different levels of maintenance—LLC’s have fewer reporting requirements and can operate solely with members acting as the managers. Conversely, corporations are required to hold certain annual meetings, keep certain records, and appoint boards and officers to manage the company for the stockholders. Every situation is unique so we recommend that you consult with an attorney in making your decision. Contact our firm, Richards Brandt, if we can help you decide which entity is right for you.

BUSINESS TRANSACTIONS & CORPORATE GOVERNANCE – CASE STUDIES

Utah Manufacturing Company Needed Employment Contracts For Key Staffers

Utah Construction Company Needed Planning For Business Growth & Protection

Utah Family Enterprise Needed Guidance and Representation to Sell Business

REVIEWS

Lien Foreclosure Action Reversed-Construction Industry Appeal

Zack Peterson

February 2015

Pentalon v. Rymark

http://www.utcourts.gov/

The Court of Appeals reversed the district court’s grant of summary judgment in favor of the lender in a mechanics’ lien foreclosure action. The district court ruled that excavations for footings and foundations were not sufficient improvements to constitute commencement of work under the 2008 version of 38-1-5.

As a matter of law, the Court of Appeals determined the contractor’s excavation work, which included excavations in specific shapes through the use of heavy machinery on site, was sufficient to constitute commencement of work under the statute. Davis, J. dissented on the grounds that he would not rule as a matter of law, and he believed issues of fact predominated.

UIM Coverage Under Automobile & Umbrella Policy

February 2015

Kingston v. State Farm

http://www.utcourts.gov/opinions/appopin/kingston150205.pdf

The Court of Appeals affirms the district court’s grant of summary judgment to State Farm on a question of UIM coverage under an automobile policy and a separate umbrella policy.

The substitution of a vehicle and an automatic renewal of a policy do not constitute «new policies» which trigger a renewed obligation to secure an insured’s consent to lower UIM limits. The insured’s initial waiver carries forward. An umbrella policy is not an automobile policy and subject to the same requirements of a policy for automobile coverage. Also, the insured was not entitled to coverage under the umbrella policy because the automobile policy did not contain sufficient coverage for UIM benefits to trigger the umbrella policy.

The substitution of a vehicle and an automatic renewal of a policy do not constitute «new policies» which trigger a renewed obligation to secure an insured’s consent to lower UIM limits. The insured’s initial waiver carries forward. An umbrella policy is not an automobile policy and subject to the same requirements of a policy for automobile coverage. Also, the insured was not entitled to coverage under the umbrella policy because the automobile policy did not contain sufficient coverage for UIM benefits to trigger the umbrella policy.

The substitution of a vehicle and an automatic renewal of a policy do not constitute «new policies» which trigger a renewed obligation to secure an insured’s consent to lower UIM limits. The insured’s initial waiver carries forward. An umbrella policy is not an automobile policy and subject to the same requirements of a policy for automobile coverage. Also, the insured was not entitled to coverage under the umbrella policy because the automobile policy did not contain sufficient coverage for UIM benefits to trigger the umbrella policy.

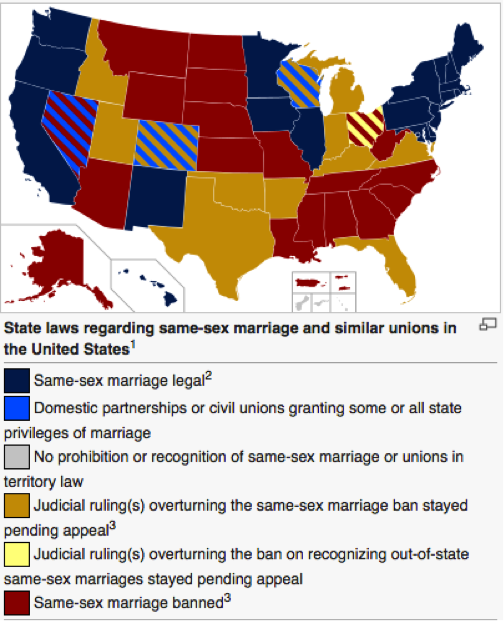

Same Sex Marriage – SCOTUS Watch is On

September 30, 2014

U.S. Supreme Court Justices began private meetings yesterday, September 29, 2014, and the Justices could decide whether to take up the issue of same sex marriage rulings from 4 federal appellate court decisions. Currently, 36 states have laws allowing or prohibiting same sex marriage. Same sex marriages are allowed in 19 states and the District of Columbia. Judges in 14 states have struck down prohibitions to same sex marriage.

Five states (UT, OK, VA, IN, WI) filed Petitions for a Writ of Certiorari requesting the Supreme Court to review federal circuit decisions affirming district court decisions finding same sex marriage prohibitions unconstitutional. In addition to the states, 30 corporations, including Alcoa, Amazon, eBay, General Electric, Intel, NIKE, Pfizer, and Target, have filed requests that the Supreme Court should address same sex marriage laws and recognize same sex marriages nationwide.

Some of the recent decisions that SCOTUS could review, include:

- Fourth Circuit – Bostic v. Schaefer, Nos. 14-1167, -1169, & -1173, 2014 U.S. App. LEXIS 14298 (4th Cir. 2014), aff’m Bostic v. Rainey, 970 F. Supp. 2d 456 (E.D. Va. 2014) (affirming grant of summary judgment to plaintiffs and enjoining enforcement of Virginia Marriage Laws at issue). [Petition for Writ of Certiorari filed Aug. 22, 2014]

- Seventh Circuit – Baskin v. Bogan, Nos. 14-2386 & -2526, 2014 U.S. App. LEXIS 17294 (7th Cir. 2014) (affirming district courts in Wisconsin and Indiana which determined prohibitions on same sex marriages were unconstitutional). [Petition for Writ of Certiorari filed Sept. 9, 2014]

- Tenth Circuit – Kitchen v. Herbert, 755 F.3d 1193 (10th Cir. 2014), aff’m Kitchen v. Herbert, 961 F. Supp. 2d 1181 (D. Utah 2013) (holding that Utah Code Ann. §§ 30-1-2, 30-1-4.1, and Utah Const. art. I, § 29 which defined marriage as between a man and woman and prohibited same sex marriage were unconstitutional). [Petition for Writ of Certiorari filed Aug. 5, 2014]

- Tenth Circuit – Bishop v. Smith, No. 14-5003 & 14-5006, 2014 U.S. App. LEXIS 13733 (10th Cir. 2014), aff’m Bishop v. United States ex rel. Holder, 962 F. Supp. 2d 1252 (N.D. Okla. 2014) (holding same sex couples had standing to attack constitutionality of Okla. Const. art. 2, § 35 prohibition of same sex marriage). [Petition for Writ of Certiorari filed Aug. 6, 2014]

Recently, a Louisiana district court judge bucked the current trend of finding same sex legislation unconstitutional. This decision is Robicheaux v. Caldwell, No. 13-5090, 2014 U.S. Dist. LEXIS 122528 (D. La. 2014) (granting defendants’ motion for summary judgment and holding that Louisiana, under a rational basis standard of review, has a legitimate interest in defining the meaning of marriage through democratic process). This decision echoes the sentiment of the dissenting opinion in the Kitchens v. Herbert decision.

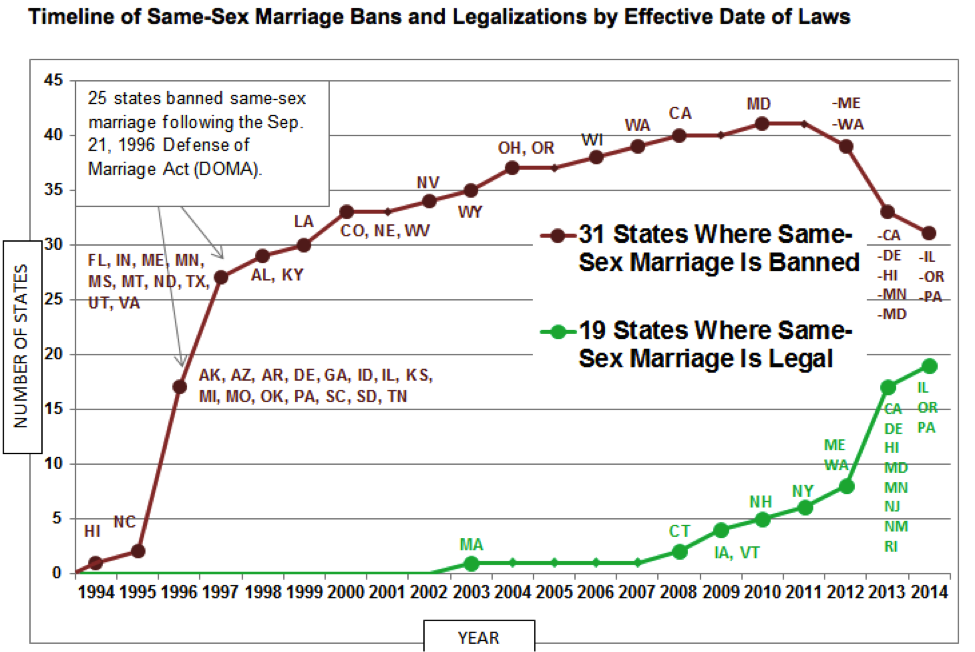

Timeline Banning & Legalizing Same Sex Marriage

Timeline Banning & Legalizing Same Sex Marriage

The watch is now on; we shall see how SCOTUS decides to address or duck the issue.

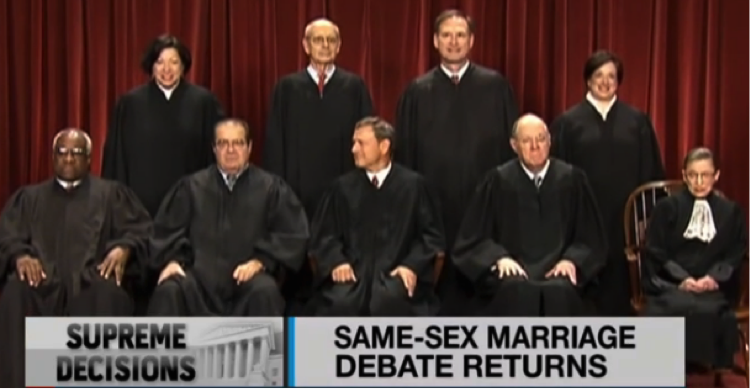

U.S. Supreme Court Justices Back row (left to right): Sonia Sotomayor, Stephen G. Breyer,Samuel A. Alito, and Elena Kagan. Front row (left to right):Clarence Thomas, Antonin Scalia, Chief Justice John G. Roberts, Anthony Kennedy, and Ruth Bader Ginsburg

U.S. Supreme Court Justices Back row (left to right): Sonia Sotomayor, Stephen G. Breyer,Samuel A. Alito, and Elena Kagan. Front row (left to right):Clarence Thomas, Antonin Scalia, Chief Justice John G. Roberts, Anthony Kennedy, and Ruth Bader Ginsburg

Utah’s Petition for Writ of Certiorari in Kitchens v. Herbert – Same Sex Marriage

September 2014

In legal circles as in life, be careful what you wish for. The news is out that Utah has filed a Petition for a Writ of Certiorari in the same sex marriage case. Utah is requesting the United States Supreme Court to review the 10th Circuit’s ruling upholding the Utah district court’s decision that the Amendment 3 unconstitutional.

As you may know, Utah’s Amendment 3, Article I, Section 29 on [Marriage.] reads (1) Marriage consists only of the legal union between a man and a woman. (2) No other domestic union, however denominated, may be recognized as a marriage 070-416 or given the same or substantially equivalent legal effect.

In a surprising move to some, the plaintiffs in Utah’s same sex marriage case indicated that they intend to join in Utah’s request to have the 10th Circuit’s ruling reviewed. The Salt Lake Tribune reporter accurately noted: «victors rarely ask for a rematch.» The pundits have started weighing in on the chances of the United States Supreme Court accepting the case for discretionary review.

In a nutshell, the plaintiffs’ decision to join rather than oppose Utah’s petition should give the State and those who oppose same-sex marriage pause for thought. The reason that the plaintiffs have decided to join in the State’s request is that Amendment 3 and the arguments that Utah is advancing in its support represent the best case – in the plaintiffs’ view – to have the United States Supreme Court uphold the unconstitutionality of same sex marriage laws. As the articles discuss, other states and other federal circuits have similar challenges in the pipeline. For proponents of same sex marriage, Amendment 3 is one of the, if not the, least defensible laws percolating up through the federal circuits. The plaintiffs want to argue Amendment 3 is unconstitutional rather than some other state’s statute because it is an easier argument to make.

Appellate court decisions are an effective means to achieve favorable laws in many areas of the law and in industry and commerce. Savvy parties and legal advocates, however, carefully choose which cases to appeal and which to accept in defeat. Perhaps Utah will be successful, and as the pundits note, it is likely that Utah’s petition will be joined with another state or states similar to petition, meaning that the United States will be considering other same 070-460 sex marriage bans in conjunction with Amendment 3. Nonetheless, the plaintiffs’ decision to join Utah’s petition is a telling sign as to how Amendment 3 compares to other states’ laws.

Additional Articles:

http://www.sltrib.com/sltrib/news/58165963-78/court-marriage-state-utah.html.csp

http://www.sltrib.com/sltrib/politics/58263347-90/utah-marriage-state-court.html.csp

http://www.scotusblog.com/2014/08/same-sex-couples-to-support-court-review-on-marriage/.

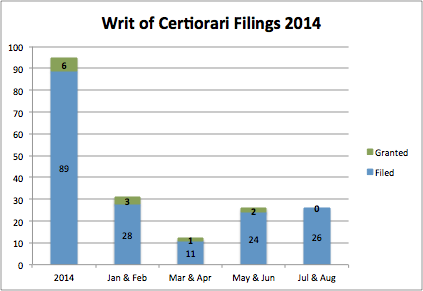

Petitions for Writ of Certiorari – Utah Court of Appeals

Zack Peterson

August 2014, Updated September 2014

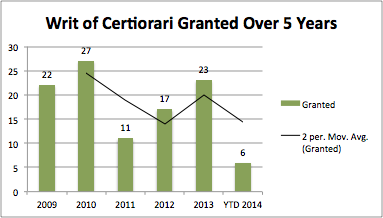

In any given year, the Utah Court of Appeals issues in excess of 300 published decisions and this number is often close to, if not in excess of, 400 opinions. This means that 200 parties in a given year leave Utah’s intermediate appellate court with a feeling of dissatisfaction.

The Court released its statistics for July and August of 2014, and the numbers continue to trend downward in the number of Writs being issued. In July and August, 26 petitions were filed, and the Court granted none of the petitions. Through the first two-thirds of 2014, the Court has granted about 7% of the petitions filed.

Over the last five years, about half of these displeased parties instruct their counsel to petition the Utah Supreme Court to review the court of appeals’ decision for correctness. Historically, roughly 20% of these petitions result in the Utah Supreme Court exercising its power of discretionary review. For those tracking these numbers, that equates to about 5% of the losing parties who are able to successfully lobby the Utah Supreme Court to review the Court of Appeals’ decisions.

How are the parties who are unsuccessful at the intermediate court faring in having their case heard at the Utah Supreme Court this year? Through the first half of 2014, the number of petitions for a Writ of Certiorari is about average or slightly above average; however, the Utah Supreme Court has only granted about 10% of the petitions. This rate is lower than the historical averages at roughly 20%. Perhaps the number of writs issued will increase in the second half of 2014.

Lien Foreclosure Action Reversed-Construction Industry Appeal

UIM Coverage Under Automobile & Umbrella Policy

Same Sex Marriage – SCOTUS Watch is On